Today we’d like to introduce you to Kyan Kumar.

Hi Kyan, we’re thrilled to have a chance to learn your story today. So, before we get into specifics, maybe you can briefly walk us through how you got to where you are today?

Yes, of course! I’ve always been passionate about numbers and curious about how money works behind the scenes. Growing up in Studio City, I noticed that conversations about money rarely happened in classrooms, even though financial stress affected so many families around me. That stuck with me.

During high school, I took it upon myself to learn more about finance—how to budget, save, invest, and build credit. I realized quickly that these weren’t just adult skills; they were essential tools that teenagers needed, too. So I started visiting schools around Los Angeles — Mirman School, Hamilton High School, Boys and Girls Clubs —giving short talks and workshops on money management for teens. I made it practical and relatable: how to save for a new phone, how to avoid debt, how to support yourself with smart decisions.

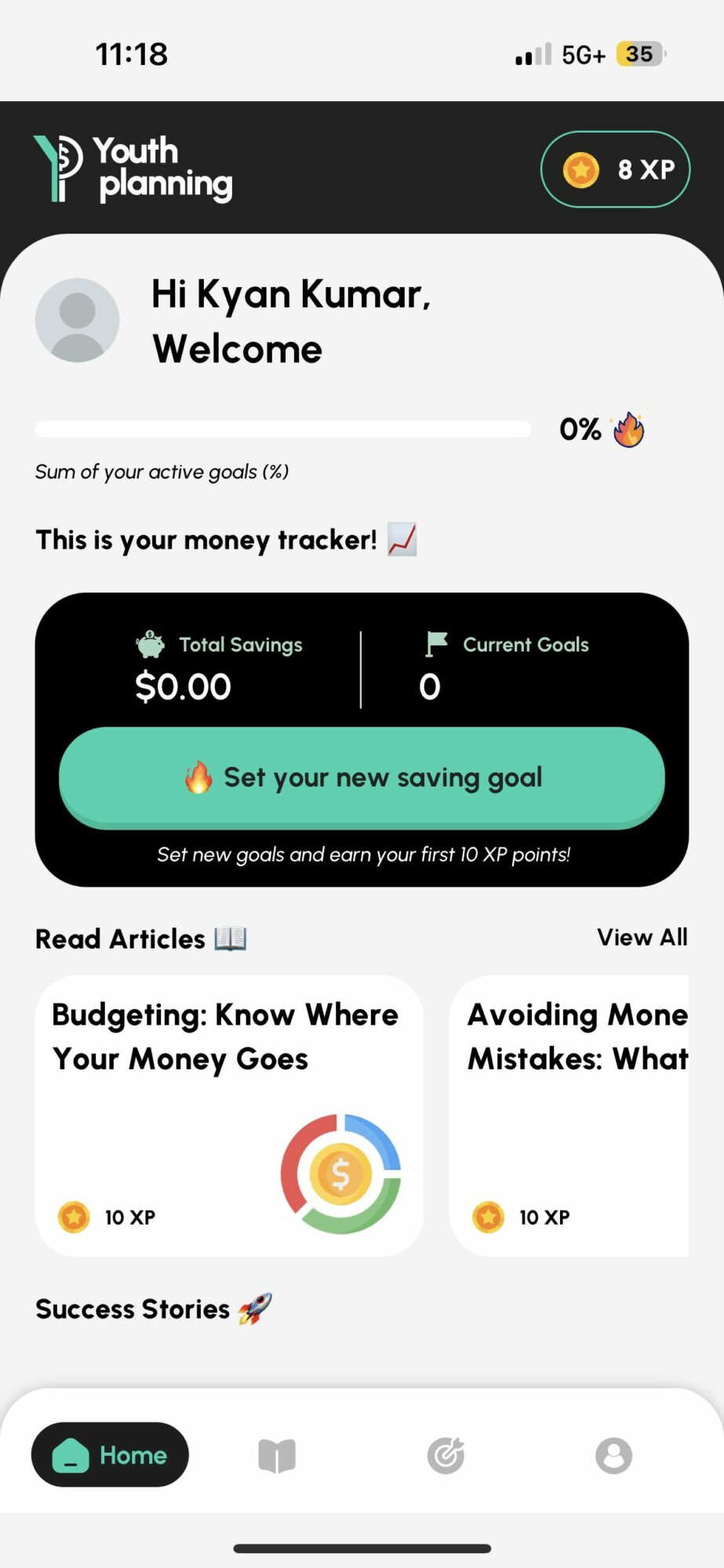

But there was only one of me—and hundreds of thousands of teens. So I built YouthPlanning, an app that teaches financial literacy through interactive lessons and real-life scenarios. Now, with over 4,000 global downloads, the app reaches students in and beyond the Valley. I still go school to school in-person, because those face-to-face moments matter. But now, students can keep learning on their own terms, anytime, anywhere.

This journey has been deeply personal. I didn’t start with a nonprofit or a huge budget—just an idea and a desire to help people like me. The Valley shaped who I am, and I’m proud to give back to it by helping the next generation take control of their financial futures.

I’m sure it wasn’t obstacle-free, but would you say the journey has been fairly smooth so far?

It definitely hasn’t been a smooth road. One of the biggest challenges has been consistency—especially when it comes to organizing school visits. A lot of times, I’d reach out to educators or administrators, and we’d have an amazing conversation about how important financial literacy is. They’d seem really excited to bring me in to speak, but then weeks would go by with no follow-up. I’ve had to learn that not every enthusiastic “yes” turns into action, and that can be discouraging when you’re trying to make a real difference.

There were also late nights—plenty of them. I’d stay up on school nights debugging lines of code for the app, designing lesson plans, or sending cold emails to principals hoping someone would give me a shot. It was exhausting balancing that with being a full-time student and athlete, but I believed in what I was building. I’m still a teenager, so sometimes adults wouldn’t take me seriously at first. But I learned to be persistent—to follow up again, to show up with a clear plan, and to keep improving my message.

Eventually, some doors opened. And even if only five students show up to a session, I remind myself that changing just one mindset about money is still a win. Those struggles pushed me to create something that could live beyond a single classroom—something like YouthPlanning, where any student, anywhere, can start building a better financial future.

Thanks – so what else should our readers know about your work and what you’re currently focused on?

At my core, I’m a student-athlete. Between early morning practices, late-night homework, and weekend tournaments, my schedule is packed—but I’ve always made time for something I care deeply about: financial education. What makes my work unique is that it’s coming from someone who understands the everyday pressures teenagers face, because I’m living it too. I know what it feels like to juggle school, sports, and social life, all while trying to figure out how money fits into the future we’re building.

While I don’t have a formal career yet, I’ve carved out a space for myself as a youth financial educator. I specialize in helping teens understand personal finance in a way that actually clicks. Whether it’s through my app, YouthPlanning, or school visits across the Valley, I focus on real-life strategies—how to save, budget, invest, and make informed decisions, even before turning 18.

What I’m most proud of is starting all of this without waiting for permission. I didn’t wait to graduate or get a degree to start teaching. I saw a gap, and I filled it. And I hope that by doing so, I’ve shown other teens that they can take action on what they believe in—even with a packed schedule and a full course load.

What do you like best about our city? What do you like least?

What I love most about our city—especially the Valley—is the sense of community. Whether it’s through school events, local businesses, or even just neighbors checking in on each other, there’s a real spirit of support here. People want to see each other succeed, and that’s meant a lot to me as I’ve grown YouthPlanning and started speaking at schools across the area. There’s something really special about how the Valley shows up for its own.

What I like least? The brutal LA traffic. I live in the Valley, but my school’s on the Westside, so I basically take a mini road trip every morning. I’ve finished full podcasts, watched movies, and reevaluated my life goals—all before 8 a.m. It’s character-building, I guess. But if someone could figure out how to teleport across the 405, I’d be the first in line.

Contact Info:

- Website: https://Youth-planning.com

- Instagram: https://www.instagram.com/kyan_kumar/?locale=en

- LinkedIn: https://www.linkedin.com/in/kyan-kumar/